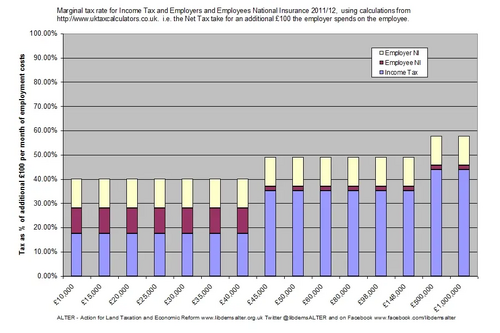

UK income based taxes are not as progressive as many think.

The chart below is the marginal tax rates for Income Tax and Employers and Employees National Insurance combined. This gives the full cost of taxes on labour, including the often forgotten Employers National insurance. When you take into account the perfectly legal ways that income taxes can be avoided with various tax reliefs like pensions etc the income based taxes are possibly flat or even regressive, rather than progressive.